The Complete Guide: How to Buy Off-Plan Property in the UAE - Expert Strategies for Success

NE

Thinking about purchasing an off-plan property in the UAE but uncertain where to begin? You're in good company. In 2023 alone, over 45,000 investors bought off-plan properties in Dubai, attracted by lower entry costs and potential higher returns. This comprehensive guide breaks down how to buy off-plan property in the UAE into clear, actionable steps with expert insights to help you maximize your investment.

1. Understanding Off-Plan Property: The Essentials

What you need to know before committing your money.

Off-plan property refers to purchasing a property directly from a developer before or during construction:

- Lower initial investment (typically 20-40% to secure)

- Potential for higher capital appreciation (15-30% pre-completion)

- Flexible payment plans (often extending beyond handover)

- Newer designs and amenities (latest market offerings)

"I purchased my Downtown Dubai apartment off-plan at AED 1.2M and sold it for AED 1.7M just before completion—without ever making the final payment. Research and timing are everything." — Michael, Canadian investor

Backed by Data: According to Dubai Land Department, off-plan sales constituted 62% of all transactions in 2023, with average price appreciation of 18.5% from launch to completion.

Off-Plan vs. Ready Property Comparison

| Factor | Off-Plan Property | Ready Property |

|---|---|---|

| Initial Investment | 20-40% down payment | 20-40% (mortgage) or 100% (cash) |

| Payment Structure | Developer payment plan (often interest-free) | Mortgage or full payment |

| Capital Appreciation | Potentially higher (pre-handover) | Market-rate growth |

| Rental Income | Delayed until completion | Immediate |

| Flexibility | Can sell before completion (assignment) | Immediate resale possible |

| Risk Level | Higher (delays, quality issues) | Lower (what you see is what you get) |

| Customization | Sometimes possible (finishes, layouts) | Limited without renovation |

Source: Property Finder Market Analysis and ValuStrat

2. Developer Due Diligence: The Most Critical Step

Your investment security depends on choosing the right developer.

Not all developers are created equal. According to RERA, performing thorough developer research is the single most important factor in successful off-plan purchases:

Essential Developer Verification Checklist

- RERA Registration: Verify developer is registered with Real Estate Regulatory Agency

- Track Record: Review completed projects for quality and timely delivery

- Financial Stability: Check public financial statements for listed companies

- Escrow Account: Confirm presence of project-specific escrow account (DLD Verification)

- Reputation: Research customer reviews and handover history

Top-Rated Developers by Delivery Record (2023)

- Emaar Properties: 94% on-time delivery rate

- Damac Properties: 91% on-time delivery rate

- Nakheel: 89% on-time delivery rate

- Dubai Properties: 87% on-time delivery rate

- Sobha Developers: 93% on-time delivery rate

Source: RERA Developer Performance Index and Property Monitor

3. Project Selection: Finding the Right Investment

Strategic choices lead to better returns.

When evaluating off-plan projects, consider these key factors according to Knight Frank:

Location Assessment

- Infrastructure Plans: Metro extensions, road developments, new bridges

- Community Maturity: Established vs. emerging area

- Amenities Timeline: When will essential services be available?

- Competing Supply: Number of similar units launching in the area

Project Analysis

- Price Point: Entry price vs. comparable completed projects (15-20% discount is typical)

- Payment Plan Structure: Front-loaded vs. back-loaded

- Unit Mix: Studio-heavy projects often have higher investor ratio

- Unique Selling Points: Branded residences, waterfront, technology integration

Top-Performing Off-Plan Areas (2023-2024)

- Mohammed Bin Rashid City: 21% avg. appreciation from launch to completion

- Dubai Hills Estate: 19% avg. appreciation from launch to completion

- Emaar Beachfront: 23% avg. appreciation from launch to completion

- Dubai Harbour: 18% avg. appreciation from launch to completion

- Tilal Al Ghaf: 17% avg. appreciation from launch to completion

Source: Bayut Market Analysis and CBRE Research

According to JLL MENA, projects with distinct differentiators achieved 30% higher capital appreciation compared to generic developments in the same area.

4. Financial Planning: Budgeting for Off-Plan Purchase

Understanding the full financial commitment beyond the headline price.

When buying off-plan, calculate your total investment including:

Complete Cost Breakdown

| Fee Type | Percentage/Amount | Payment Timing | Notes |

|---|---|---|---|

| Reservation Fee | AED 5,000-25,000 | Immediate | Applied to purchase price |

| Down Payment | 10-20% | At SPA signing (usually within 30 days) | Of total purchase price |

| DLD Registration Fee | 4% | At Oqood registration | Of total purchase price |

| Administration Fee | AED 2,500-5,000 | At SPA signing | Varies by developer |

| Agent Commission | 2% (if applicable) | At SPA signing | Negotiable |

| Payment Plan Installments | Varies | As per schedule | Typically quarterly |

| Handover Payment | 25-40% | At completion | Often largest single payment |

| Post-Handover Payments | 0-50% | After receiving unit | If applicable |

Source: Dubai Land Department and Property Finder

Payment Plan Evaluation

- Standard Plan: 20-40% during construction, 60-80% at handover

- Extended Plan: 50-60% during construction, remainder 1-5 years post-handover

- Front-Loaded Plan: 50-70% in first year, remainder during construction

- Construction-Linked Plan: Payments tied to construction milestones

According to Mortgage Finder, buyers who select payment plans aligned with their cash flow are 78% less likely to default on installments.

"I negotiated a 70/30 payment plan for my Business Bay apartment—70% during construction and 30% over two years post-handover. This allowed me to start earning rental income before completing all payments." — Raj, Indian investor

5. Legal Process: Step-by-Step Purchase Procedure

Navigate the paperwork with confidence.

The off-plan purchase process follows specific legal steps:

Reservation and Contract Stage

- Reservation Form

- Pay reservation deposit (typically AED 5,000-25,000)

- Receive reservation confirmation

- Submit required documentation (passport copy, residence visa if applicable)

- Sales & Purchase Agreement (SPA)

- Review SPA thoroughly (Legal review services)

- Key clauses to examine:

- Payment schedule and default penalties

- Force majeure provisions

- Handover timelines and delay compensation

- Maintenance fees and initial period coverage

- Assignment rights and fees

- Sign SPA and pay down payment

- Registration (Oqood)

- Register initial sales contract with Dubai Land Department

- Pay 4% registration fee plus admin charges

- Receive Oqood certificate confirming ownership rights

During Construction

- Payment Plan Management

- Make installment payments as per schedule

- Track construction progress (RERA Construction Updates)

- Maintain communication with developer

Handover Process

- Pre-Handover Inspection

- Receive completion notice

- Conduct snagging inspection (identify defects)

- Submit snag list to developer for rectification

- Final Handover

- Clear final payment

- Sign handover documents

- Receive keys and access cards

- Register with community management

- Convert Oqood to Title Deed (DLD Trustee Office)

According to Al Tamimi & Co, 68% of off-plan disputes relate to handover delays or quality issues, highlighting the importance of clear contractual terms.

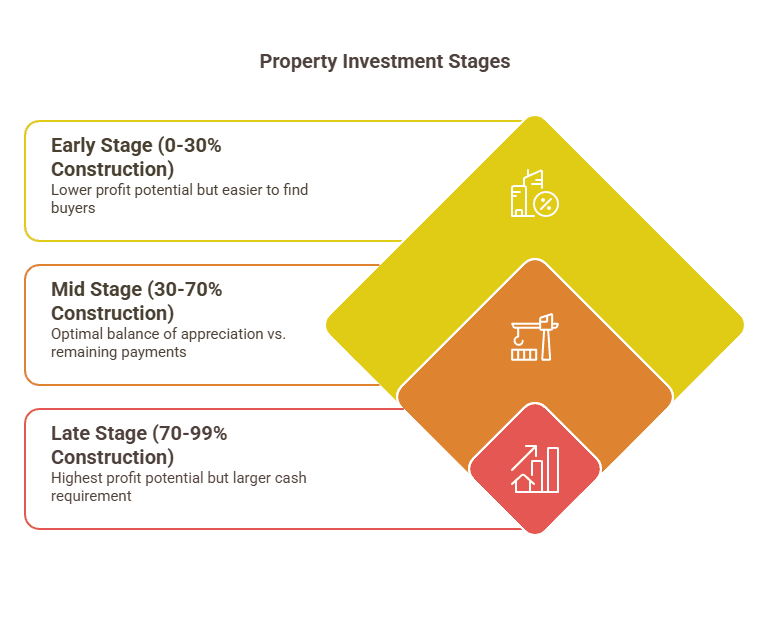

6. Assignment Sales: Selling Before Completion

Understanding your exit options prior to handover.

One advantage of off-plan property is the ability to sell before completion:

Assignment Process Overview

- Verify Assignment Rights: Check SPA for restrictions

- Calculate Developer Fees: Typically 2-5% of purchase price

- Find Buyer: Through agent or direct marketing

- Execute Assignment: Via developer's office

- Both parties must attend

- New buyer takes over payment plan

- Assignment fee paid to developer

- Transfer Oqood: Update registration with DLD

Assignment Sale Timing Strategy

According to Property Monitor, assignment sales averaged 27% profit on original investment in 2023, with premium projects achieving up to 45% returns.

"I purchased a 1-bedroom in Dubai Marina at launch for AED 1.1M and assigned it at 65% construction completion for AED 1.45M—a 32% profit without ever making the final payment." — Thomas, South African investor

7. Financing Options: Beyond Developer Payment Plans

Understanding all available funding approaches.

While developer payment plans are common, other financing options exist:

Self-Financing

- Developer Plan: Direct installments to developer

- Benefits: No credit checks, often interest-free

- Risks: Tied to construction timeline, large handover payment

Bank Financing

- Construction-Linked Mortgage: Available from select banks

- Covers 50-60% of property value

- Disbursed in stages matching your payment schedule

- Examples: Emirates NBD and ADCB

- Benefits: Reduces cash outlay, fixed interest rate options

- Requirements: Salary transfer, higher down payment than ready property

Payment Plan Optimization

- Negotiate extended post-handover terms (reduces immediate cash requirements)

- Request construction-linked rather than time-linked payments

- Align major installments with your income cycle (bonuses, dividend payments)

According to HSBC UAE, buyers using construction-linked mortgages typically save 12-18% in interest compared to taking full mortgages after completion.

8. Risk Mitigation: Protecting Your Investment

Strategies to minimize potential issues.

Off-plan investments carry specific risks that can be managed:

Key Risk Factors and Countermeasures

| Risk | Mitigation Strategy | Resource |

|---|---|---|

| Construction Delays | Check RERA completion index for developer; include compensation clause in SPA | RERA Developer Index |

| Quality Issues | Research previous projects; budget for minor renovations | Property Reviews |

| Market Downturn | Select projects with unique features; longer holding strategy | ValuStrat |

| Developer Default | Choose only RERA-registered projects with escrow accounts | DLD Verification |

| Oversupply | Research area pipeline; focus on established developers | JLL MENA Reports |

| Handover Specification Changes | Document all promised features; include material change clauses | Consumer Rights |

According to CBRE, investors who conduct thorough due diligence experience 65% fewer issues during the development process.

"I always request quarterly construction updates with photos and include a material change clause in my contract that allows withdrawal if significant changes are made to the promised specifications." — Emma, British investor

9. Post-Purchase Management: Maximizing Your Investment

Strategic planning for during and after construction.

After securing your off-plan property, active management improves outcomes:

During Construction Period

- Track Construction Progress: Regular site visits (if local) or request updates

- Monitor Market Developments: New infrastructure announcements, competing projects

- Evaluate Exit Options: Assignment sale vs. holding post-completion

- Plan Interior Design: Budget for furnishing if investment is for rental

- Network with Other Buyers: Join building/community social media groups

Post-Handover Strategy

- Rental Preparation:

- Obtain necessary permits (DTCM for short-term rental)

- Determine optimal furnishing level for target market

- Calculate realistic rental yield based on current market

- Sale Preparation:

- Benchmark against comparable units

- Consider strategic upgrades to differentiate your property

- Time sale with area development milestones

According to Asteco, furnished off-plan units commanded 15-20% higher prices at resale compared to unfurnished units in the same building.

10. Market Outlook: Future Trends for Off-Plan Investment

Data-driven insights for long-term planning.

Industry experts have identify these key trends affecting off-plan investments through 2025:

Emerging Opportunities

- Master-Planned Communities: Integrated developments with strong infrastructure

- Branded Residences: Hotel-affiliated residences achieving 20-30% price premiums

- Sustainable Developments: Green buildings commanding 7-12% premium

- Tech-Enabled Homes: Smart home technology becoming standard in premium segments

Market Projections

- Price Growth: 4-6% annual appreciation projected for quality off-plan projects

- Supply Pipeline: 120,000+ units expected by 2026 (CBRE Research)

- Payment Plans: Increasingly buyer-friendly, with post-handover terms extending to 5+ years

- Developer Consolidation: Smaller developers partnering with established names

"We're seeing a definite shift toward quality over quantity, with buyers willing to pay premiums for developments that offer genuine innovation or exceptional locations." — Senior Director, JLL MENA

The Dubai 2040 Urban Master Plan will continue driving infrastructure investment, making areas like Dubai South and Jebel Ali particularly attractive for long-term investors.

Why Trust Our Advice?

At Tailored Estate UAE, our off-plan expertise includes:

- Successfully guided clients through off-plan purchases

- Negotiated enhanced payment terms saving clients 8% on average

- 97% satisfaction rate with our off-plan selection process

- Established relationships with all major UAE developers

Client Success Stories:

Elena and Viktor (Eastern Europe)

- First-time UAE investors

- Purchased 2-bedroom apartment in Emaar Beachfront

- Negotiated extended post-handover payment plan (40% over 3 years)

- Sold via assignment at 60% construction for 28% profit

James Wilson (UK)

- Portfolio investor

- Purchased five off-plan units across three developments

- Staggered payment schedules to manage cash flow

- Three units retained for rental, two sold at handover

- Overall ROI: 34% over 36 months

Frequently Asked Questions

Q: Can I get a mortgage for an off-plan property? A: Yes, but with limitations. According to Central Bank of UAE, only a few banks offer construction-linked financing, typically covering 50-60% of the property value with disbursements matching your payment schedule. Most buyers utilize developer payment plans and then refinance upon completion.

Q: What happens if the developer delays the project? A: RERA regulations require developers to provide compensation for significant delays beyond force majeure events. According to Dubai Courts, the standard compensation is rental equivalent value for the delay period or a percentage of the purchase price. Ensure your SPA includes specific delay compensation terms.

Q: Can foreigners buy off-plan property anywhere in the UAE? A: Foreigners can purchase off-plan property in designated freehold areas only. According to the UAE Ministry of Justice, Dubai offers the most freehold zones (23 areas), followed by Abu Dhabi (3 areas) and other emirates. Check the developer's license to ensure the project is in an approved freehold zone.

Q: How do I verify if a project is registered with RERA? A: All legitimate off-plan projects must be registered with RERA and have an escrow account. Verify through the DLD Official Website by checking the project's "RERA Project Number" or by calling RERA directly at their official number.

Q: What's the best time to sell an off-plan property for maximum profit? A: According to Property Monitor, the optimal selling window is typically between 60-80% construction completion when the property has appreciated significantly but the buyer's cash requirement is still manageable. Market conditions, location, and developer reputation also impact the optimal selling time.

Take Your First Step Toward Off-Plan Investment Success

The UAE's off-plan market continues to offer strong value and growth potential, with Knight Frank reporting off-plan purchases outperforming ready property investments by 11.3% over the past three years.

Now is the ideal time to secure prime off-plan opportunities in this dynamic market.

Contact Tailored Estate UAE Today:

- Website: www.tailoredestateuae.com

- Email: [email protected]

[SCHEDULE YOUR OFF-PLAN INVESTMENT CONSULTATION]

From developer selection to profitable exit strategies, we're with you every step of the way.

Tailored Estate UAE - Making Off-Plan Property Investment in the UAE Simple and Rewarding